Who Can Be Eligible for Equity Release Mortgages and Why

Who Can Be Eligible for Equity Release Mortgages and Why

Blog Article

How Equity Release Mortgages Can Effect Your Financial Future and Retirement Program

Equity Release home loans existing both possibilities and challenges for individuals preparing their monetary futures and retired life. They can give immediate liquidity, alleviating the worry of living expenses. However, these items also lessen the worth of estates, influencing inheritance for successors. Understanding the subtleties of equity Release is important. As people explore their options, they must take into consideration the broader ramifications on their financial wellness and legacy. What choices will they deal with in this complex landscape?

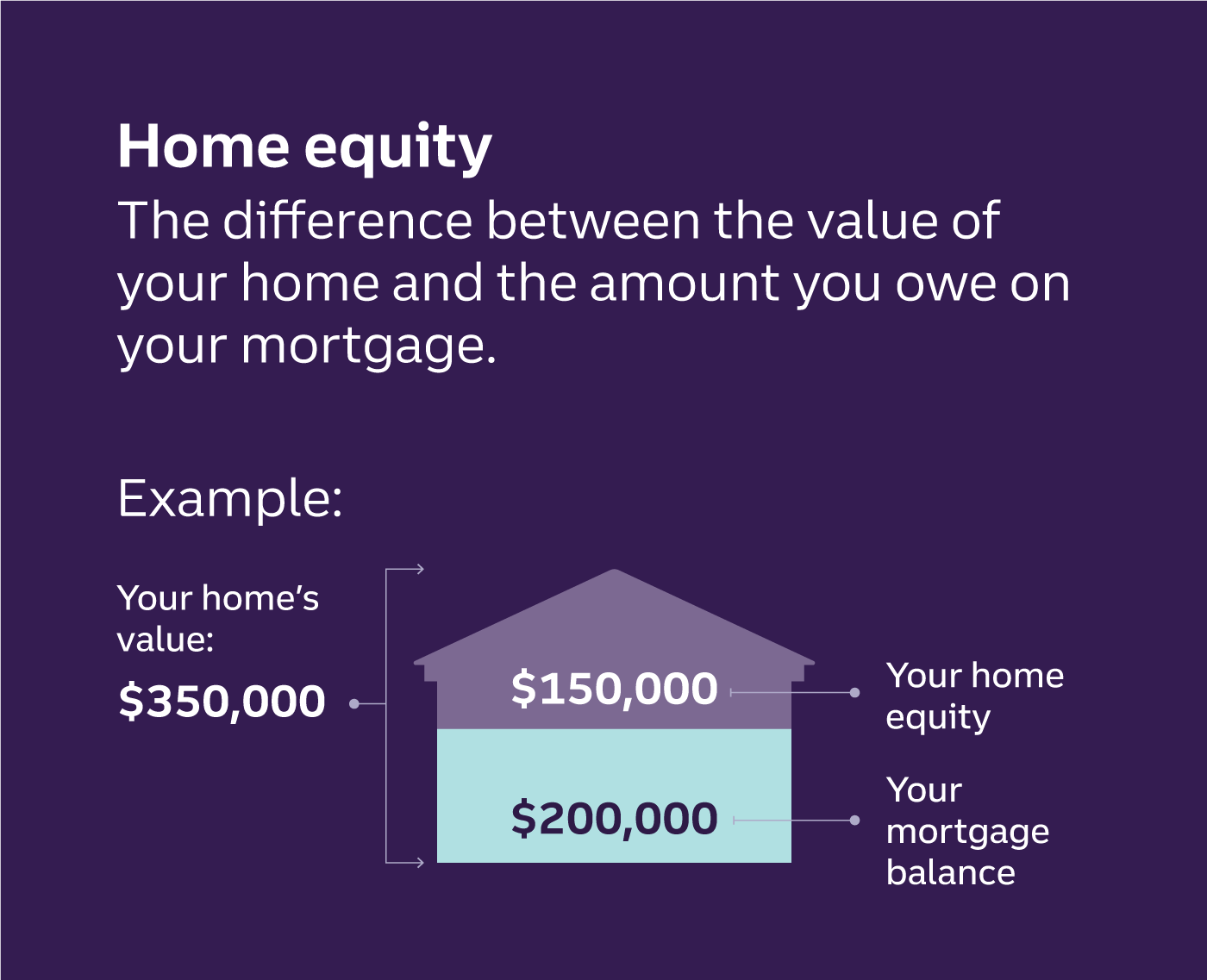

Recognizing Equity Release Mortgages: What You Required to Know

Sorts Of Equity Release Products Available

Equity Release products been available in numerous forms, dealing with various requirements and choices of homeowners. Both key kinds are lifetime mortgages and home reversion plans.Lifetime mortgages allow homeowners to borrow versus their residential property while maintaining possession. The lending, plus passion, is generally paid back upon fatality or when the home is marketed. This alternative provides adaptability and permits continued residence in the home.Conversely, home reversion intends involve marketing a portion of the home to a service provider in exchange for a lump amount or normal settlements. The property owner keeps the right to stay in the home up until they pass away, yet the provider gains possession of the sold share.Both items have distinct advantages and factors to consider, making it crucial for people to analyze their economic circumstances and long-lasting goals before proceeding. Recognizing these alternatives is essential for educated decision-making regarding equity Release.

How Equity Release Can Provide Financial Alleviation in Retired Life

Immediate Money Accessibility

Several retirees face the challenge of taking care of taken care of incomes while navigating rising living costs, making immediate cash money accessibility an important factor to consider. Equity Release home mortgages supply an efficient option, enabling house owners to access the worth of their buildings without the requirement to offer. This monetary device makes it possible for retired people to access a swelling sum or normal repayments, supplying them with the essential funds for day-to-day expenditures, unexpected costs, or also recreation tasks. By taking advantage of their home equity, retirees can minimize monetary tension, maintain a comfortable lifestyle, and maintain their financial savings for emergency situations. Immediate cash money gain access to with equity Release not just improves monetary flexibility but also equips retirees to enjoy their retired life years with better tranquility of mind, totally free from instant monetary restrictions.

Financial Debt Debt Consolidation Advantages

Accessing prompt cash money can considerably boost a senior citizen's financial scenario, however it can also act as a critical tool for handling current financial debts. Equity Release home mortgages give a chance for retirees to touch right into their home equity, supplying funds that can be utilized to combine high-interest financial debts. By repaying these financial obligations, retired people might minimize regular monthly financial burdens, permitting a much more manageable budget plan. This technique not just simplifies financial resources yet can additionally boost overall economic security. In addition, the money acquired can be alloted towards essential expenses or financial investments, additionally sustaining retirement. Inevitably, utilizing equity Release for financial debt consolidation can bring about substantial long-lasting economic relief, making it possible for retirees to enjoy their golden years with greater satisfaction.

The Influence of Equity Release on Inheritance and Estate Planning

The choice to utilize equity Release can significantly modify the landscape of inheritance and estate planning for individuals and their families. By accessing a section of their home's worth, home owners may greatly lower the equity readily available to hand down to beneficiaries. This option can create a complex dynamic, as individuals have to evaluate immediate financial needs versus long-term heritage goals.Moreover, the funds launched with equity can be utilized for various functions, such as improving retired life lifestyles or covering unexpected costs, yet this usually comes with the expenditure of future inheritance. Family members might deal with difficult conversations relating to assumptions and the effects of equity Release on their monetary legacy.Additionally, the obligations linked to equity Release, such as payment problems and the possibility for lessening estate value, need cautious factor to consider. Ultimately, equity Release can reshape not only economic situations but likewise family partnerships and assumptions bordering inheritance.

Tax Obligation Ramifications of Equity Release Mortgages

The tax ramifications of equity Release mortgages are important for house owners considering this choice. Particularly, resources gains tax obligation and inheritance tax obligation can considerably affect the financial landscape for people and their heirs (equity release mortgages). Recognizing these factors to consider is necessary for reliable economic planning and monitoring

Resources Gains Tax Obligation Considerations

While equity Release mortgages can supply home owners with immediate monetary relief, they also lug potential tax effects that need to be very carefully considered. One vital facet is funding gains tax obligation (CGT) When a homeowner launches equity from their home, they may deal with CGT if this contact form the property worth boosts and they make a decision to sell it in the future. The gain, which is determined as the distinction between the selling price and the original purchase rate, goes through tax. Homeowners can profit from the main house alleviation, which may spare a section of the gain if the home was their main home. Recognizing these nuances is essential for property owners planning their financial future and evaluating the long-lasting impact of equity Release.

Estate Tax Effects

Thinking about the possible ramifications of estate tax is vital for home owners opting for equity Release mortgages. When homeowners Release equity from their building, the amount taken out may influence the value of their estate, potentially enhancing their inheritance tax obligation obligation. In the UK, estates valued over the nil-rate band limit are subject to estate tax at 40%. Because of this, if a home owner utilizes equity Release to money their retirement or other expenditures, the staying estate may significantly decrease, influencing beneficiaries. In addition, home owners must take into consideration the timing of equity Release, as very early withdrawals can bring about higher tax obligation implications upon fatality. Therefore, recognizing these variables is crucial for effective estate planning and making certain that beneficiaries get their desired tradition.

Evaluating the Dangers and Benefits of Equity Release

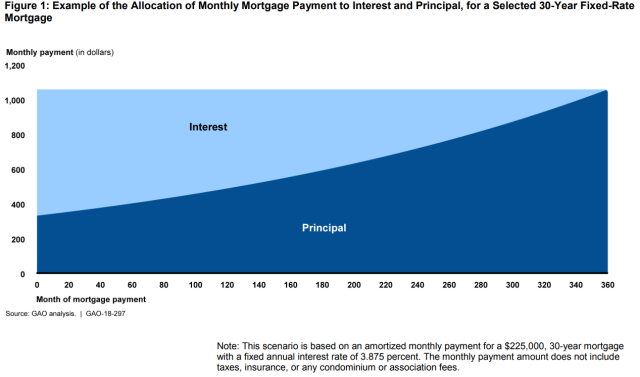

Equity Release can supply substantial financial benefits for home owners, yet it is important to evaluate the associated risks before continuing. One of the primary benefits is the ability Find Out More to access tax-free money, enabling individuals to fund their retired life, make home renovations, or help relative financially. Nevertheless, the ramifications on inheritance are considerable, as launching equity reduces the value of the estate handed down to heirs.Additionally, rate of interest on equity Release products can be greater than traditional mortgages, causing raised financial debt with time - equity release mortgages. House owners should also consider the potential effect on means-tested advantages, as accessing funds might impact eligibility. Moreover, the intricacy of equity Release items can make it testing to comprehend their long-lasting effects totally. Therefore, while equity Release can offer prompt monetary relief, an extensive assessment of its risks and benefits is crucial for making knowledgeable decisions regarding one's monetary future

Making Informed Choices Regarding Your Financial Future

Home owners deal with a wide range of options when it pertains to managing their monetary futures, particularly after considering alternatives like equity Release. Enlightened decision-making is important, as these selections can greatly affect retired life plans and total economic health and wellness. Home owners need to start by thoroughly looking into the ramifications of equity Release, consisting of prospective effect on inheritance and future treatment expenses. Engaging with monetary consultants can supply personalized insights, enabling people to recognize the long-term consequences of their decisions.Moreover, property owners have to think about alternative options, such as downsizing or various other forms of financing, to identify one of the most appropriate course. Reviewing one's monetary circumstance, including assets and financial obligations, is essential for making a versatile decision. Eventually, a careful assessment of all available options will empower house owners to navigate their financial futures with confidence, guaranteeing they align with their retirement goals and personal aspirations.

Regularly Asked Questions

Can I Still Move Home if I Have an Equity Release Home Loan?

The individual can move home with an equity Release home mortgage, however should adhere to specific lending institution conditions. This typically includes repaying the existing home loan, which could impact their financial scenario and future plans.

Exactly How Does Equity Release Impact My State Advantages Eligibility?

Equity Release can influence state advantages qualification by boosting assessable income or resources. Individuals may experience decreases in advantages such as Pension Credit Scores or Real estate Benefit, potentially impacting their total monetary assistance during retired life.

What Happens if I Outlast My Equity Release Plan?

If an individual outlives their equity Release strategy, the home loan normally continues to be basically up until their passing or relocating into long-lasting treatment. The estate will be accountable for clearing up the debt from the home's worth.

Can I Repay My Equity Release Home Loan Early?

Repaying an equity Release home mortgage very early is generally feasible but may involve fees or penalties. Borrowers must consult their loan provider for certain terms, as each plan varies in conditions concerning early settlement options.

Are There Age Restrictions for Getting Equity Release?

Equity Release typically imposes age restrictions, usually requiring candidates to be a minimum of 55 or 60 years of ages. These limitations guarantee that people are coming close to retirement, making the scheme a lot more suitable for their economic additional info situation.

Conclusion

In summary, equity Release home loans provide a possible financial lifeline for retired people, supplying immediate cash access to enhance lifestyle. They come with substantial considerations, consisting of impacts on inheritance, estate preparation, and tax obligation obligations. Extensively assessing the benefits and risks is vital for guaranteeing that such choices align with long-lasting economic objectives. Consulting with a financial advisor can aid individuals navigate these intricacies, ultimately supporting a more enlightened and safe economic future. Equity Release home mortgages are monetary products created for homeowners, normally aged 55 and over, permitting them to access the equity linked up in their home. Equity Release home mortgages offer a possibility for senior citizens to tap into their home equity, providing funds that can be made use of to settle high-interest debts. Households may encounter difficult conversations concerning assumptions and the effects of equity Release on their monetary legacy.Additionally, the commitments connected to equity Release, such as settlement problems and the potential for reducing estate value, need careful factor to consider. While equity Release home loans can supply homeowners with immediate economic relief, they additionally bring possible tax obligation implications that must be very carefully considered. The effects on inheritance are significant, as releasing equity reduces the value of the estate passed on to heirs.Additionally, rate of interest prices on equity Release products can be higher than standard mortgages, leading to increased financial debt over time.

Report this page